- Wage subsidies have helped keep unemployment in check during the COVID-19 pandemic.

- The taxpayer-funded programmes have inflated deficits in many countries.

- Winding down the programmes before the pandemic recedes could be disastrous.

Taxpayers in the UK have curbed unemployment during COVID-19 by compensating companies for keeping idled workers on the payroll. But as in other countries deploying this policy tool, it's been costly – potentially inflating the UK’s deficit to nearly twice its peak during the last global financial crisis.

Temporary wage subsidies have been implemented at an unprecedented scale as governments around the world respond to the pandemic’s crippling impact. Many are blowing past established deficit limits as they desperately seek to stem unemployment and prop up economies amid the worst global downturn since the Great Depression. The schemes seem to be working. But if this pricey form of taxpayer-funded relief disappears before COVID-19 is quelled, it could have devastating consequences.

A European Union spending agreement reached earlier this week is designed to help budget-constrained members weather the crisis – potentially bolstering employment subsidies. One-third of the workforce in France, Germany, Italy, Spain and the UK has been covered by employment subsidy programmes, according to one estimate, and the measures have generally suppressed unemployment rates across the region.

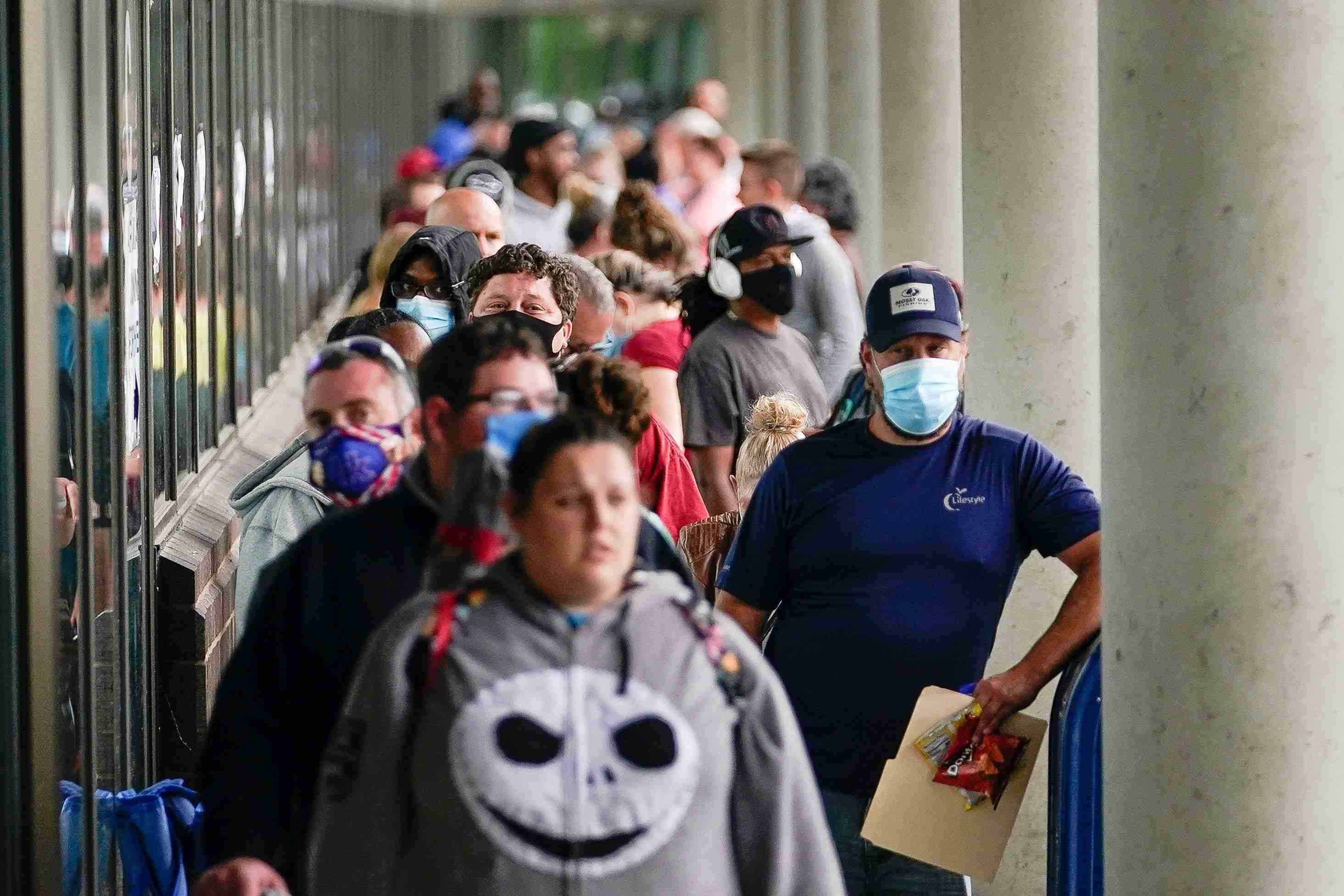

In contrast, unemployment in North America has already spiked. That points to differences in worker protections, as the US in particular makes it easier to fire employees than European countries. It also adds a greater sense of urgency to efforts to shore up the workforce. Canada, which hit a record high 13.7% monthly unemployment rate in May, is offering to subsidize 75% of an employer’s wages for up to 24 weeks.

In the US, a government loan programme forgives the principal if it’s used to continue paying employees. The programme has cost the equivalent of 3.1% of GDP, and according to one estimate it was financially supporting 6% of the country’s labour force as of May. It’s also made headlines with the disclosure of seemingly questionable recipients, like the Los Angeles Lakers (the NBA team ultimately returned its $4.6 million loan).

Australia recently announced the extension of a wage subsidy programme that’s contributed to the country’s biggest budget deficit since World War II. Payments are slated to decline, however, given that the programme has been burning through AUD $11 billion a month (together with a companion initiative helping job seekers).

Japan had a relatively tight labour market before the pandemic hit – for every 120 job openings, there were an estimated 100 job seekers as of April. In addition, the government’s outbreak response has largely been deemed a success, and there is a cultural predisposition to avoid layoffs. Nonetheless, employers have been offered subsidies to pay furloughed workers. One research report suggested that if the people furloughed were counted as unemployed, Japan’s official unemployment rate would’ve been 11.4% in April rather than 2.6%.

The UK has also maintained relatively low unemployment. It has implemented programmes including an offer to subsidize 80% of a furloughed employee’s wages. These programmes were estimated to have cost the Treasury £22 billion by May.

Despite their heavy cost, experts say winding down wage subsidy programmes prematurely could spell trouble. In places like Canada, efforts have been made to relax programme rules and make it even easier to obtain funds.

For more context, here are links to further reading from the World Economic Forum’s Strategic Intelligence platform:

- In India, the National Rural Employment Guarantee Scheme, the supply of subsidized food grains, and cash transfers to women and farmers have all proven to be useful buffers against unemployment in a country where agriculture employs 42% of the workforce, according to this analysis. (Brookings)

- Germany’s introduction of a minimum wage in 2015 raised concerns about increased job losses that never materialized, according to this analysis, which argues that Europe should now consider a regionally differentiated minimum wage system to blunt the impact of the pandemic. (Social Europe)

- UK Chancellor Rishi Sunak says once the country’s current wage subsidy scheme ends in October, it will be replaced by a £1,000 bonus for each employee retained until January 2021 – a sign the government’s emergency spending won’t abate despite a soaring budget deficit, according to this analysis. (The Conversation)

- The director of the Brookings Race, Prosperity, and Inclusion Initiative recently recommended that COVID-19 recovery efforts in the US include charging the Federal Reserve with lowering the black unemployment rate until it matches white unemployment, and mandating that employers of low-wage workers provide paid leave. (Brookings)

- The devastating job losses in the US during the past few months have affected all Americans, but according to this collection of data, black, Hispanic, and other workers of colour have suffered especially steep declines. (ProPublica)

- There are fears that the employment situation in the UK could seriously deteriorate after the government winds down its program to support furloughed workers, and this analysis calls for a rethinking of a neoliberal model that’s become “increasingly destructive.” (The Conversation)

- Some of the most vital workers during the pandemic have been neglected as they remain employed – according to this report, public health workers in the US have stayed on the job after contracting the coronavirus, and they’ve been tasked with confronting COVID-19 after public health spending per person declined by 16% in the country between 2010 and 2018. (Kaiser Health News)

On the Strategic Intelligence platform, you can find feeds of expert analysis related to COVID-19, the global workforce and hundreds of additional topics. You’ll need to register to view.